Locate Low-cost Auto Insurance Coverage in Chicago IL Today

Moving 1: Recognizing Car Insurance Coverage Demands in Chicago IL

Knowing the car insurance needs in Chicago, IL is actually necessary for all drivers in the urban area. In Chicago, like in several various other areas, car insurance coverage is actually mandatory for anybody running a vehicle when driving. The minimal obligation insurance coverage demanded in Chicago is $25,000 for physical injury each, $50,000 for bodily trauma every accident, and $20,000 for residential or commercial property damages. Additionally, drivers have to bring uninsured driver insurance coverage to safeguard themselves in situation they are associated with a crash along with an uninsured driver. Failure to comply with these demands can easily lead to penalties, license suspension, or other legal repercussions.

Apart from the required lowest protection, drivers in Chicago may also select to include various other sorts of insurance coverage to their policies, like wreck, extensive, as well as health care payments insurance coverage. These added coverages can deliver more defense in the occasion of an incident or even various other unanticipated situations. It's vital for drivers to understand their insurance needs to have as well as ensure they possess adequate insurance coverage to protect themselves and also their vehicles while driving of Chicago.

Heading 2: Elements that Influence Car Insurance Costs in Chicago IL

Factors that determine car insurance prices in Chicago, IL may differ considerably from individual to person. One vital factor is the age of the driver, as much younger drivers often tend to have greater fees as a result of their absence of knowledge on the roadway. Furthermore, the kind of car being actually guaranteed participates in a substantial task, along with even more high-performance or even costly vehicles frequently causing greater fees. Yet another crucial element is actually the driving document of the covered by insurance individual, as those with a background of accidents or even traffic violations may face boosted costs.

Furthermore, where the covered by insurance individual everyday lives can also affect their car insurance policy fees in Chicago, IL. Urban regions along with higher fees of crashes or even burglary might possess much higher costs matched up to additional country regions. In addition, the protection options selected by the policyholder, like thorough coverage or roadside support, may Cheap auto insurance Back of the Yards chicago additionally determine the overall cost of car insurance coverage. Insurance providers may additionally bear in mind elements like credit scores background and yearly mileage driven when calculating costs for car insurance coverage policies in Chicago, IL.

Heading 3: Tips for Decreasing Your Car Insurance Policy Fee in Chicago IL

Maintaining an excellent credit report can easily also positively affect your car insurance policy superior. Insurer typically consider your credit rating when finding out prices, therefore keeping your debt in great standing may cause reduce prices. Additionally, opting for a much higher insurance deductible may help reduce your fee. Through accepting to spend more out of wallet in the celebration of a case, insurer might supply you a decreased fee.

Another helpful technique to reduce your car insurance costs is actually by capitalizing on offered savings. A lot of insurance provider use price cuts for risk-free driving records, accomplishing protective driving courses, or even bundling numerous policies all together. It costs discovering these options to observe if you receive any kind of discount rates that can help lower your insurance expenses.

Moving 4: Comparing Various Car Insurer in Chicago IL

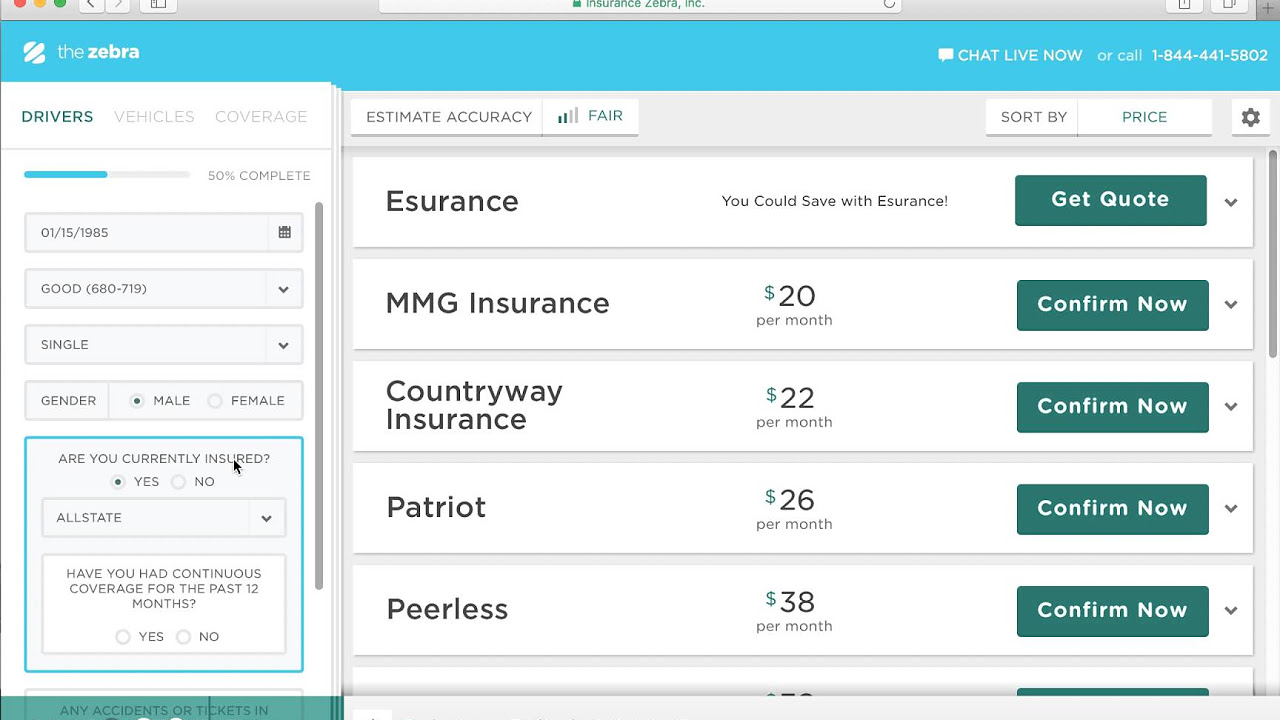

When it concerns choosing a car insurer in Chicago, IL, it's vital to match up various choices to find the most ideal suitable for your demands. Each insurance coverage company supplies varying insurance coverage choices, discounts, and customer care adventures. Through looking into as well as reviewing several companies, you can easily make a knowledgeable choice that fits your finances as well as protection requirements.

One efficient means to match up different car insurance policy companies in Chicago, IL is to ask for quotes from several companies. Through acquiring quotes, you can easily review premiums, deductibles, as well as coverage limitations parallel. Also, think about exploring each firm's credibility and reputation, client testimonials, and also financial strength to ensure they are reliable and also trusted. Taking the opportunity to review and also comparison numerous insurance business can aid you discover the correct balance between price as well as quality insurance coverage for your vehicle.

Heading 5: Taking Advantage Of Savings and Bundling Choices for Cheaper Car Insurance Coverage in Chicago IL

To take full advantage of cost savings on your car insurance in Chicago, make the most of discount rates and also packing alternatives delivered by insurance provider. A lot of insurance providers offer price cuts for numerous aspects including possessing a well-maintained driving file, completing a defensive driving program, or even being actually a secure driver. Bundling your car insurance coverage along with various other policies like home or occupants insurance policy can likewise cause significant price reductions. By merging your insurance coverage needs to have with one service provider, you may get approved for an affordable price generally.

Furthermore, check out various other possible markdowns that insurance carriers in Chicago might provide, including discounts for army personnel, trainees along with really good levels, or memberships in specific organizations. Some insurer provide markdowns for vehicles with safety attributes like anti-theft tools, air bags, or even anti-lock brakes. Through discussing these possibilities along with your insurance representative or even researching online, you can easily customize your policy to consist of all eligible price cuts, inevitably reducing your car insurance policy costs in Chicago.

Moving 6: Relevance of Maintaining a Great Driving Report for Affordable Car Insurance Coverage in Chicago IL

Keeping a clean driving file is actually vital for protecting economical car insurance policy costs in Chicago, IL. Insurer typically check out drivers with a record of traffic infractions, incidents, or driving under the effect much more riskily, bring about raised fees. By following web traffic legislations, performing secure driving behaviors, as well as preventing citations, insurance policy holders can easily illustrate their obligation when traveling, which often translates in to lesser insurance policy expenses.

Furthermore, a great driving file certainly not only impacts the cost of insurance yet also plays a notable part in identifying qualification for numerous markdowns and also incentives delivered through insurance carriers. Many firms supply safe driver discounts to those along with a clean document, compensating them for their dedication to roadway safety. Through regularly keeping a great driving record, insurance holders not only secure on their own and also others when traveling however likewise place on their own to access even more economical insurance options in Chicago, IL.

Moving 7: Looking Into Different Protection Options for Car Insurance Coverage in Chicago IL

When it concerns car insurance in Chicago, IL, there are actually several insurance coverage options offered to drivers. Understanding these different alternatives may aid you adapt your plan to meet your details needs. The best general form of protection is responsibility insurance policy, which is actually required through law in Illinois and covers loss and personal injuries you induce to others in an incident. In addition, you can go with collision protection, which aids pay out for problems to your personal vehicle in case of a crash, despite fault.

Comprehensive protection is an additional option that may offer security for problems not led to through a wreck, like theft, hooliganism, or all-natural disasters. Individual accident security (PIP) deals with health care costs for you as well as your passengers, irrespective of fault, while uninsured/underinsured driver coverage may assist cover expenses if you reside in an accident with a driver who doesn't have insurance or enough insurance coverage. Through exploring these different coverage choices and comprehending exactly how each may benefit you, you can easily help make an updated choice when choosing a car insurance plan in Chicago, IL.

Moving 8: How to Outlet Around for the very best Car Insurance Sell Chicago IL

Purchasing around for the greatest car insurance coverage handle Chicago, IL may be a taxing yet valuable undertaking. To begin, it's important to compile quotes coming from several insurance provider to review costs and also coverage options. Internet comparison devices can easily be beneficial in this particular process, allowing you to input your details once and also receive quotes from numerous insurance companies all at once. In addition, do not neglect to look at local insurance coverage agencies that may supply tailored service as well as reasonable costs.

Once you have acquired quotes coming from several insurance coverage service providers, make the effort to assess and contrast the coverage degrees, deductibles, and also any fringe benefits used. It is necessary to make sure that you are actually certainly not simply receiving a good rate however likewise appropriate insurance coverage for your needs. Less costly does not consistently indicate better when it comes to car insurance, so consider the expense against the amount of security each policy uses. Performing in depth analysis as well as contrast prior to deciding can help you locate the most effective car insurance policy handle Chicago, IL that meets both your finances and also insurance coverage requirements.

Heading 9: Understanding the Claims Refine along with Car Insurance in Chicago IL

Car insurance claims can easily be a difficult as well as stressful procedure for several drivers in Chicago, Illinois. When it pertains to suing, it is actually necessary to know the measures involved and the requirements placed forth by your insurance coverage company. It is actually critical to advise your insurance business promptly after an incident or even any sort of event that might lead to an insurance claim. Be actually prepped to provide in-depth info regarding the accident, including the day, opportunity, area, and explanation of what happened. Your insurance company may also ask for records such as images, cops files, as well as call relevant information of parties included.

Once you have actually filed an insurance claim with your car insurance provider in Chicago, IL, an adjuster is going to be actually assigned to determine the damages as well as identify the protection provided under your plan. It is very important to cooperate along with the insurance adjuster, supply accurate relevant information, and also react immediately to any kind of ask for extra information. Keep track of all communication and also paperwork related to your claim to guarantee openness and also a soft insurance claims process. Bear in mind that recognizing the claims procedure and definitely taking part in the settlement may help quicken the dealing with of your case as well as ensure you receive the settlement you are allowed to.

Moving 10: Evaluating Client Satisfaction and Scores for Car Insurance Companies in Chicago IL

When it happens to deciding on a car insurance provider in Chicago, IL, assessing consumer total satisfaction and also rankings may provide beneficial ideas right into the overall premium of company and also states dealing with. Through analyzing client assessments and ratings, you can easily gauge the degree of complete satisfaction amongst policyholders and identify if a particular insurance policy provider meets your demands and also assumptions. Client reviews may offer firsthand accounts of the consumer experience, aiding you make an informed selection when deciding on a car insurance carrier in Chicago.

In addition, keeping an eye on client fulfillment and also ratings for car insurance provider in Chicago, IL, may support you in determining any type of reoccuring concerns or usual problems that insurance policy holders might have. By analyzing feedback coming from other consumers, you can easily examine just how the insurance provider takes care of insurance claims, customer support inquiries, as well as any type of prospective conflicts. Recognizing the knowledge of other insurance policy holders can easily assist you in selecting a car insurance coverage service provider that prioritizes client contentment and also demonstrates a devotion to dealing with problems immediately and rather.

Featured Auto Insurance Agency

Insurance Navy Brokers

1801 W 47th St, Chicago, IL 60609